Why China's Real-Name Policy Could Change Your Social Media Forever—The Shocking Results Will Leave You Speechless!

Mandatory real-name identification has emerged as a significant regulatory measure impacting the informativeness of social media in financial contexts. According to recent research, the implementation of this policy has led to a notable decline in the predictive capacity of social media sentiment regarding firms' unexpected earnings.

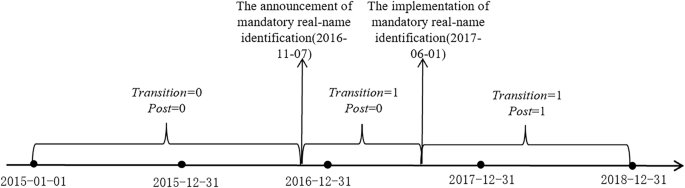

In a detailed analysis, researchers examined the effects of real-name identification on social media postings, particularly looking at how this policy has altered user behavior and information sharing. The findings indicate that prior to the introduction of mandatory real-name identification, social media sentiment did not significantly alter its ability to predict unexpected earnings. However, after the policy was enacted, the informativeness of social media sentiment experienced a dramatic drop.

Specifically, the coefficient of the interaction term SM_Senti[-10,-2]×Post was found to be -0.1527, statistically significant at the 1% level. This suggests that after the mandatory identification policy's implementation, the ability of social media sentiment to predict unexpected earnings decreased by approximately 69%, signaling a chilling effect on users' willingness to share potentially valuable information.

To establish a clearer timeline of this trend, the study performed trend tests that confirmed the pre-policy behavior of social media was largely unaffected. The lack of significant results in the interaction terms for periods leading up to the policy further bolstered this finding, indicating that the decline in informativeness was indeed a consequence of the new regulations.

Shifting the analysis to user-specific impacts, researchers categorized social media users into two groups: anonymous and those who voluntarily disclosed their real identities. Utilizing generative artificial intelligence, specifically GLM-4 developed by Zhipu AI, the study successfully classified users based on their profile information and posting behavior. Post-analysis revealed that anonymous users were more significantly impacted by the mandatory real-name policy, as indicated by a negative coefficient for the sentiment of anonymous users’ postings, which was statistically significant at the 1% level. In contrast, the sentiment of front-end real-name users remained largely unaffected.

Additional layers of analysis looked into the influence of users based on their follower counts, proposing that those with a more substantial following would exhibit increased caution in their postings to avoid regulatory scrutiny. The results supported this hypothesis, with high-follower users showing a significant decrease in the informativeness of their posts after the policy was enacted. This suggests that influential users are particularly aware of the regulatory risks associated with their online comments, further diminishing the overall impact of social media sentiment on financial predictions.

The content of social media postings also underwent a transformation. Researchers noted a marked decrease in the proportion of predictive posts, definite statements, and personal opinions following the introduction of the policy. This indicates that users are likely becoming more cautious about sharing opinions that could expose them to regulatory scrutiny.

From a broader market perspective, the implications of these findings are significant. The study revealed that the decline in the informativeness of social media sentiment correlates with diminished market responses to stock prices. An examination of cumulative abnormal returns indicated a significant negative relationship between social media sentiment and market reactions after the implementation of the real-name policy. Furthermore, trading volume volatility declined, and the degree of information asymmetry between institutional and retail investors may have increased as a result of the diminished social media sentiment.

To ensure the robustness of these conclusions, the researchers conducted various sensitivity analyses, confirming that the observed trends held true under different model specifications and methodologies.

In summary, the introduction of mandatory real-name identification has led to a significant reduction in the predictive capacity of social media regarding unexpected earnings, particularly among anonymous users and those with larger followings. The chilling effect of these regulations poses critical questions about the future of social media as a source of financial insights and its overall role in capital market dynamics.

You might also like: