Stock Market Shock: Is This 20% Dip Your Last Chance to Grab This UK Gem Before It Soars?

The UK stock market is showing signs of stabilization after a sharp decline last week. The FTSE 100, the UK’s flagship index, dropped to 9,698 points on November 14, reflecting a 3% fall over the week. This dip followed a surge earlier in the week, when it approached record levels near 10,000 points. As investors evaluate the current state of the market, pressing questions arise: What factors are influencing these fluctuations, and where might the market head by 2026?

David Solomon, CEO of Goldman Sachs, recently indicated that investors should prepare for a potential market pullback within the next 12 to 24 months. He is not alone in this sentiment; Jamie Dimon, CEO of JP Morgan, echoed similar concerns, citing high valuations, geopolitical uncertainty, and government spending as significant risks to market stability. However, it's essential to note that predictions of a crash are not guaranteed. If inflation continues to cool and interest rates decline, corporate earnings could align more closely with valuations, potentially easing bubble concerns without necessitating a severe correction.

Timing the market has always been a challenge, even for seasoned professionals. Currently, all eyes are on Chancellor Rachel Reeves as she prepares to present her Autumn Budget on November 26. Analysts expect the government to address a fiscal gap estimated between £30 billion and £40 billion, likely through a combination of tax increases and spending adjustments.

While reports suggest that income tax and corporation tax rates will remain unchanged, other forms of taxation might see increases. Experts also speculate about possible adjustments to income tax thresholds or National Insurance contributions. The critical question for the stock market is how these measures will impact consumer spending and business confidence. Sectors such as retail, hospitality, and real estate could face heightened vulnerability if household budgets are further squeezed.

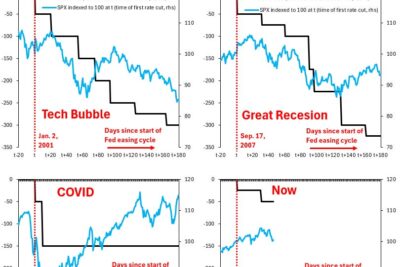

Additionally, lower interest rates may provide a boost to the economy. This month, the Bank of England opted to hold the interest rate at 4%, but markets are currently pricing in a 60%-65% chance of a rate cut in December. The outlook for UK banks has been challenging recently, with major players like Barclays, HSBC, and Standard Chartered experiencing declines. In contrast, shares of advertising giant WPP surged by 5% following reports of takeover interest from French rival Havas and private equity firms Apollo and KKR.

One particularly intriguing story within the FTSE 100 is that of 3i Group (LSE: III). The private equity firm saw its share price plummet by around 20% in just five days after releasing its latest financial results. On the surface, the numbers appeared robust, with revenue and earnings rising by 62% and 49% year-on-year, respectively. The company also declared an interim dividend of 36.5 pence per share, up from 30.5 pence the previous year. However, the sell-off can be attributed to CEO Simon Borrows’ cautious outlook regarding the challenging environment ahead.

Specifically, Borrows expressed concerns over weak performance in France from the group’s key holding, Action, a Dutch discount retailer that constitutes nearly 70% of 3i’s £29 billion portfolio. Given this context, 3i Group may seem attractively undervalued, currently trading at around 5.2 times earnings. Despite notable risks, such as the potential for Action’s sales growth to fall short of the previously outlined 6.1% target, the company’s long-term prospects remain solid, presenting an opportunity worth considering for investors.

As market dynamics continue to shift, the upcoming weeks will be crucial in shaping investor sentiment and overall economic expectations. The resolution of fiscal uncertainties, interest rate decisions, and corporate performance will play significant roles in determining the trajectory of the UK stock market moving into 2026.

You might also like: