Shocking New Map Reveals States Facing Up to 30% Health Insurance Hikes—Are You Prepared?

Millions of Americans are facing a financial storm as enhanced Affordable Care Act (ACA) premium tax credits are set to expire at the end of this year, leading to the likelihood of dramatically higher health insurance bills in 2024. These enhanced subsidies have played a critical role in lowering monthly premiums for individuals across various income brackets, but without Congressional intervention, the expiration could result in significant increases for enrollees.

The ACA marketplace, launched in 2010, provides health insurance options for those who do not qualify for Medicaid and are not covered by employer-sponsored plans. Enhanced Premium Tax Credits were introduced in 2020 to help alleviate financial burdens during the COVID-19 pandemic. These subsidies have substantially reduced monthly premiums, with some low-income enrollees even paying $0.

According to the Congressional Budget Office, failing to extend these subsidies would lead to more than doubling premiums for many enrollees in 2024, pushing an estimated 2 million additional Americans into the ranks of the uninsured. This potential crisis highlights the fragile nature of healthcare affordability in the U.S.

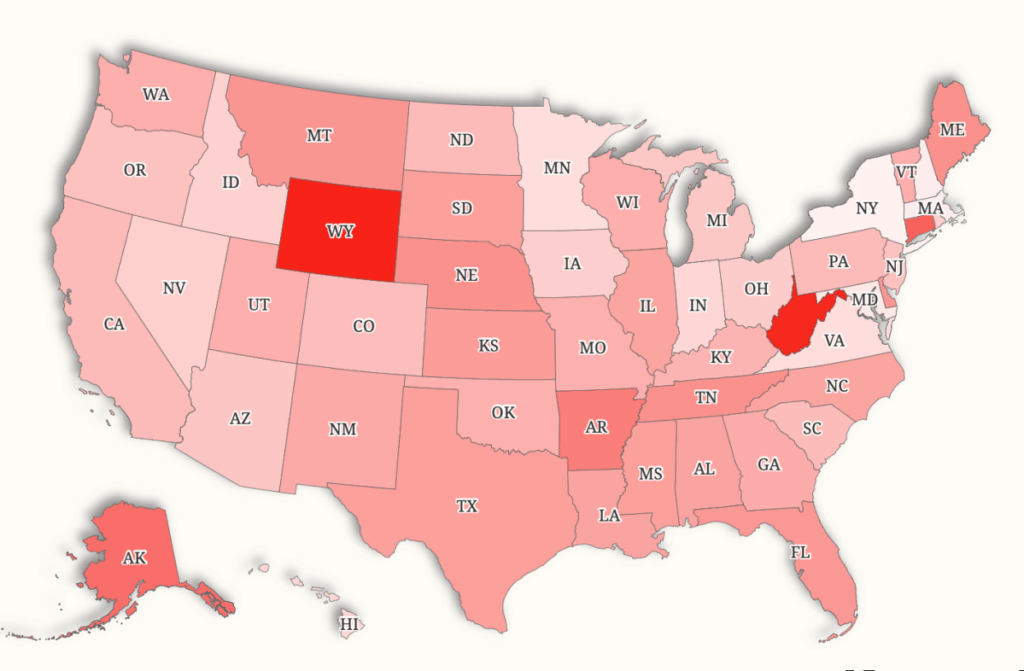

The Most Affected States

Analysis from the Kaiser Family Foundation (KFF) reveals that the financial impact will be particularly severe for older adults with middle incomes—those earning just above the previous eligibility threshold for ACA subsidies. For individuals at 401 percent of the federal poverty level, which equates to $62,757 in the contiguous U.S., the expiration of enhanced credits would lead to a significant spike in costs. For example, a 60-year-old at this income level could see average annual premiums for a benchmark silver plan at least double in 46 states and Washington, D.C. In 19 of these states, premiums would triple, consuming more than a quarter of an individual's annual income.

The states projected to experience the most substantial increases include:

- Wyoming: +$22,452 per year

- West Virginia: +$22,006

- Alaska: +$19,636

Professor Stacey B. Lee from Johns Hopkins University and CEO of Praxis Pacisci explained that these states often suffer from limited insurer competition, smaller populations, high provider prices, and geographic challenges that drive up care delivery costs. “In these markets, the gross premiums, meaning the price before subsidies, can exceed $30,000 a year for a 60-year-old," she noted. "The enhanced credits did more than reduce premiums; in many cases, they made coverage mathematically possible for middle-income residents.”

While some states face drastic increases, others anticipate smaller yet still significant hikes:

- New York: +$4,469

- Massachusetts: +$4,728

- New Hampshire: +$4,877

According to Professor Lee, states like New York and Massachusetts had pre-existing rules stabilizing their individual markets, such as community rating and guaranteed issue, before the enhanced tax credits arrived. These states already had deeper risk pools and predictable pricing, which lessens the impact of the subsidy expiration.

As income levels rise, the number of states where premiums are expected to double decreases significantly. For those at 501 percent of poverty (approximately $78,407 for an individual), premiums would at least double for a 60-year-old in 37 states and D.C. This figure drops to 19 states at 601 percent of poverty and further narrows to just five states at 701 percent. In contrast, premium increases for 40-year-olds are considered “more modest” across all income levels.

Looking ahead, the political landscape complicates matters. President Donald Trump recently stated that he does not favor extending the expiring subsidies under the ACA, which could lead to sharp premium hikes for enrollees next year. "I’d rather not extend them at all," he said during a press briefing while traveling to Florida. While he acknowledged that some form of extension may be necessary to facilitate other legislative efforts, he criticized the ACA, calling it “a disaster.”

The Trump administration has claimed it is working to prevent the substantial premium hikes that would come from the looming expiration of ACA subsidies, but the future remains uncertain. As the end of the year approaches, millions of Americans may find themselves in a precarious position without renewed legislative support, raising critical questions about healthcare accessibility and affordability in a country where healthcare costs continue to rise.

You might also like: