Korea’s Startup Scene Is Stalling: Are New Regulations Crushing the Next Unicorn? You Won’t Believe What’s at Stake!

South Korea’s startup ecosystem, once hailed as a burgeoning innovation hub, is now facing a troubling stagnation. The nation boasts only 13 unicorns—private startups valued at over one trillion won—placing it at 11th globally. This contrasts sharply with the United States, which added 229 new unicorns during the same period, highlighting a disparity not due to a lack of talent, but rather deep-rooted structural barriers inhibiting innovation and investment.

Data from the Korea Chamber of Commerce and Industry (KCCI), based on CB Insights’ global unicorn list, reveals that South Korea's unicorn count has increased from 11 in 2021 to 13 as of October 2025. Worldwide, there are now 1,276 unicorns, with the U.S. leading the pack at 717, constituting 56.2% of the total, followed by China with 151. This stark contrast illustrates how while U.S. unicorns grew by 229—accounting for 72% of the global increase—Korea's gain of just two unicorns stands as one of the smallest among advanced economies, surpassed only by China, which saw a decrease of 19 unicorns since 2021.

Why Korea’s Unicorn Engine Is Losing Speed

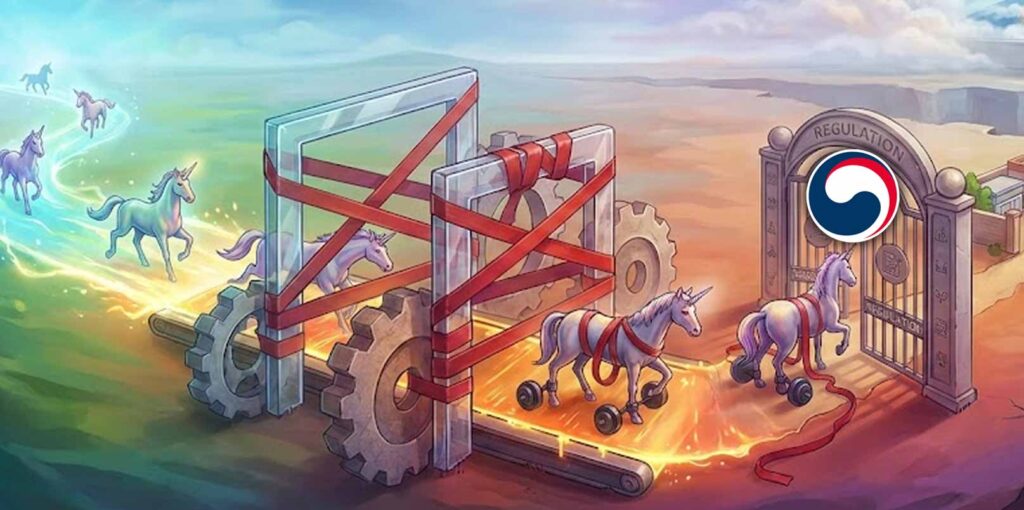

Unicorns often serve as indicators of a nation's innovation strength and potential for future growth. However, Korea's unicorn creation rate is faltering due to systemic friction. KCCI's analysis points to three primary obstacles:

- Regulatory rigidity: Korea's “positive regulation” system restricts entry into emerging industries by only allowing what is explicitly permitted.

- Growth penalties: As startups scale, they encounter heavier compliance burdens rather than incentives, which discourages further expansion.

- Limited global reach: The relatively small domestic market and sluggish foreign capital inflow limit opportunities for global competitiveness.

A spokesperson from KCCI noted, “Outdated regulations and restricted capital flow are dragging down the vitality of the startup ecosystem.”

Global comparisons further emphasize the imbalance. For instance, Israel, with 23 unicorns, and Singapore, with 16, outperform Korea despite their smaller economies. Both countries actively utilize government-backed funds and regulatory flexibility to attract investors and support early-stage ventures. Meanwhile, China remains second globally, even amidst a slowdown, primarily due to U.S. investment bans on AI, semiconductor, and quantum startups, which have caused its venture capital investment to shrink to USD 33.2 billion in 2024—representing only one-third of its 2021 level.

In Korea, the AI semiconductor startup Rebellions joined the unicorn ranks in July 2025, while MegazoneCloud achieved this milestone in just 4.12 years—the fastest among Korean firms. Nonetheless, the national average time from founding to unicorn status is 8.99 years, significantly slower than the global top ten average of 6.97 years.

Korea's unicorns are primarily concentrated in consumer goods and retail, which account for 46.1% of the total. In contrast, AI and IT solutions form 36.3% of unicorns in the top ten global economies. This distribution illustrates a growing divide: while other nations are cultivating tech-heavy unicorns in fields like artificial intelligence and advanced software, Korea's ecosystem remains anchored in consumption-driven sectors, indicating a structural challenge in scaling deep tech ventures that require longer R&D cycles and higher-risk capital.

Innovation Hubs and the Need for Policy Reform

To address this innovation gap, KCCI has proposed the establishment of innovation hub cities. These zones would cluster startups, large enterprises, universities, and investors, fostering an environment conducive to experimentation. A proposed “mega sandbox” policy would enable startups to test new technologies without regulatory constraints.

However, South Korea's policy environment often reflects a tension between protecting existing industries and promoting new innovation. Recent debates surrounding the DoctorNow Prevention Bill saga and the AI Basic Law have highlighted how regulations often favor established interests over emerging technologies. Furthermore, Korea's stringent stance on data protection versus AI innovation raises concerns among founders, who worry that privacy regulations are evolving more swiftly than frameworks supporting responsible AI growth. The recent Charzin court receivership filing has further exposed systemic fragility, demonstrating the struggles early-stage innovators face when regulatory barriers ease but market competition intensifies.

These circumstances illustrate a paradox: Korea's robust governance framework, intended to ensure safety and fairness, is increasingly suppressing the very innovation it aims to promote. In contrast, the U.S. model serves as a benchmark; 45.3% of its unicorns—325 companies—are based in California’s Bay Area, where flexible regulations, strong academic networks, and a dense investor community create a self-reinforcing loop of innovation.

KCCI’s Economic Policy Director Kim Hyun-soo articulated the urgency of the matter: “The slowdown in unicorn creation signals a loss of vitality in Korea’s startup ecosystem. We need institutional reform and greater capital inflows to rebuild the unicorn growth environment.”

The data underscores a broader truth about Korea's innovation trajectory. Despite a robust foundation in AI, semiconductors, and digital infrastructure, policy bottlenecks and capital barriers dilute its startup potential. For South Korea to maintain global competitiveness, it must transition from a control-heavy administration to a flexible innovation policy—one that adapts regulations in tandem with technological advancements. Government-backed seed funding, international investor engagement, and structural incentives for scaling firms are no longer merely optional; they are imperative for revitalizing the ecosystem. If Korea can modernize its startup policy and facilitate faster global expansion, the next wave of unicorns could emerge not just from consumer markets, but from deep tech sectors that could redefine Asia’s innovation landscape.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.

You might also like: