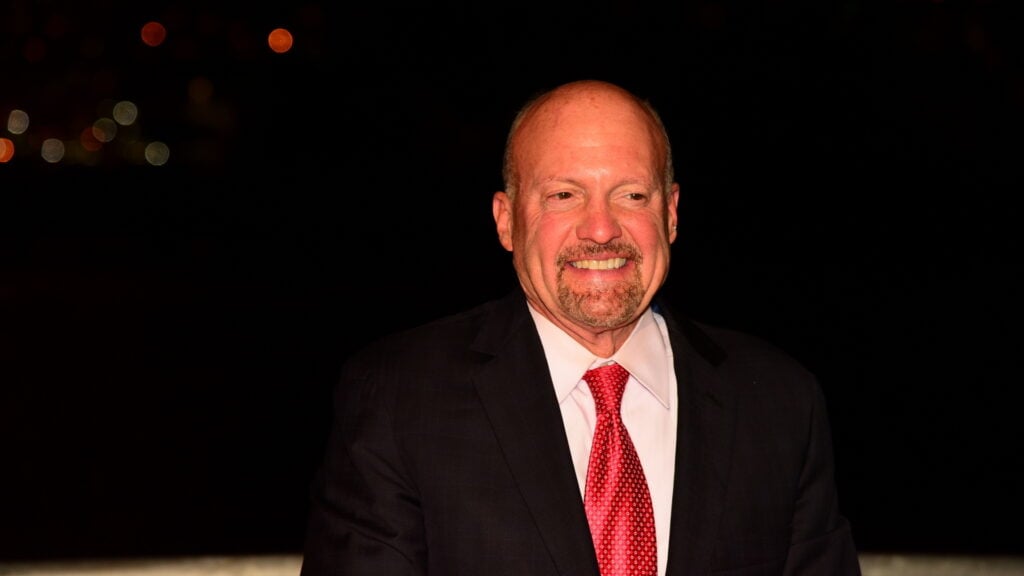

Jim Cramer Issues URGENT Bitcoin Warning! Will Michael Saylor Risk Millions in Q4 Earnings?

In a striking call to action, market commentator and TV personality Jim Cramer urged Michael Saylor, the Chair of Strategy Inc. (NASDAQ:MSTR), to intervene in the declining fortunes of Bitcoin (CRYPTO: BTC). On social media platform X, Cramer proposed that Saylor issue a zero-coupon convertible bond to protect Bitcoin's value from falling below $73,802, a figure he termed the “line in the sand.”

“Strategy’s earnings depend upon it, and what will you talk about when you report on Thursday? Let’s get this done,” Cramer quipped, blending his characteristic humor with a serious concern for the company's financial health.

“Memo to Michael Saylor, we think that $73,802 is the line in the sand for Bitcoin. Time to do another zero coupon convert and stop this decline. Strategy's earnings depend upon it and what will you talk about when you report Thursday. Let's get this done!”

Shortly after his initial post, Cramer identified another critical threshold at $73,820, reiterating his plea for Saylor to implement corporate strategies to stabilize Bitcoin's price.

“Oh my, Bitcoin $73,820 beckons as the Dow hits a record high. Our chartist last night said this is it, the level that cannot be breached. It is time for Strategy, also known as Mister for its MSTR symbol to do a spot secondary or a convert and stop this decline. Come on Mike!”

Cramer's commentary comes amid a turbulent period for Bitcoin, which has seen its value plummet to levels not experienced since November 2024. As a prominent figure in market analysis, Cramer has been vocal about the challenges facing Saylor’s Bitcoin treasury company, particularly as it reports earnings.

Last week, Strategy acquired 855 BTC at an average price of $87,974, wholly financed by selling Class A shares. This move raised questions about whether Saylor possesses sufficient capital to stem the current sell-off. As of now, Strategy holds a total of 713,502 BTC, having invested over $54 billion at an average price of $76,052 per Bitcoin. With Bitcoin's current decline, this position has recently turned negative, drawing attention from economists like Peter Schiff, who remarked on the shifting financial landscape.

“According to @Saylor, Bitcoin is the best performing asset in the world. Yet $MSTR invested over $54 billion in Bitcoin over the past five years, and as of now, the company is down about 3% on that investment. I'm sure the losses over the next five years will be much greater!”

As the company prepares to release its fourth-quarter earnings for 2025 after market close on Thursday, Saylor reiterated his commitment to a long-term HODL approach, stating that the firm is engineered to withstand an 80-90% drawdown of Bitcoin's value.

The plight of Strategy Inc. underscores a growing concern in the financial community regarding the volatility of cryptocurrencies and their impact on corporate balance sheets. The company, often viewed as a leveraged Bitcoin proxy, has amassed significant debt totaling $8.24 billion through strategic maneuvers like issuing common stock, preferred stock, and convertible bonds in hopes of capitalizing on rising Bitcoin prices. However, with Bitcoin's rapid decline, this strategy is now under intense scrutiny.

As the market stands, investors are watching closely to see how Saylor will address these challenges in the upcoming earnings report. The situation encapsulates the inherent risks and rewards of cryptocurrency investment, making it a critical topic for both seasoned traders and everyday investors alike.

You might also like: