Is ZBI Stock About to Skyrocket? Analysts Reveal a Shocking 300% Potential—Don’t Miss Out!

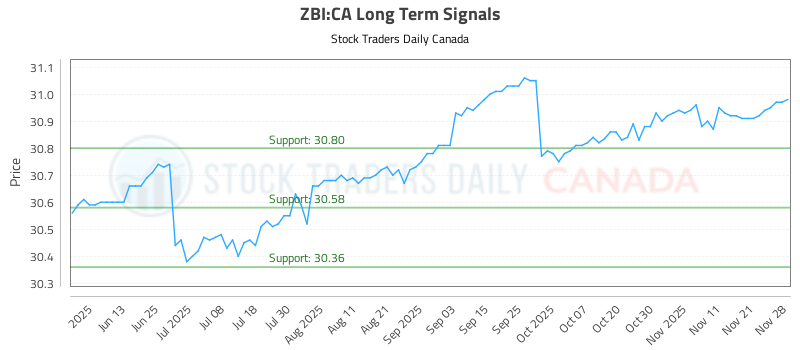

The landscape for investing in exchange-traded funds (ETFs) continues to be complex and ever-changing. Investors focusing on Canadian bank equities via the BMO Canadian Bank Income Index ETF (ZBI:CA) might find the latest trading recommendations noteworthy. As of November 29, 2025, the suggested approach for long-term traders is to "buy near 30.80," with a stop loss set at 30.65. Notably, no short plans have been offered at this time.

The most recent ratings for ZBI:CA reflect a **neutral** outlook across all investment terms—near, mid, and long. This neutral stance suggests a cautious approach, indicating that while significant gains may not be expected, the fund is also not considered a poor investment choice at the moment. This type of rating can often signal a period of consolidation in the market or a wait-and-see approach among investors.

For those considering ZBI:CA, understanding the **BMO Canadian Bank Income Index ETF** is crucial. This ETF aims to provide investors with exposure to a portfolio of Canadian bank stocks, known for their relative stability and consistent dividends. With the Canadian banking sector generally perceived as robust, many investors are drawn to such funds for income generation as well as capital appreciation.

To visualize the current performance of ZBI:CA, an AI-generated chart has been made available. This chart can help investors assess the recent trends and movements in the ETF's price, enhancing their decision-making process. The reliance on AI-generated signals in trading has grown, providing an additional layer of data analysis that some traders find beneficial.

In a broader context, the neutral rating for ZBI:CA reflects the current economic climate and market sentiment regarding Canadian banks. Factors such as interest rates, regulatory changes, and economic performance can significantly impact bank stocks. As the North American economy continues to navigate various challenges, including inflation and potential recessions, the performance of financial institutions will be closely monitored by investors.

While the recommendations for ZBI:CA may seem straightforward, they highlight the importance of timing and market awareness in the investment landscape. As always, potential investors should conduct thorough research and consider their financial goals and risk tolerance before making investment decisions.

Investing in ETFs like the BMO Canadian Bank Income Index ETF can be an effective strategy for those looking to diversify their portfolio while tapping into the income stability that strong financial institutions can provide. As of now, the cautious approach suggested by the neutral ratings might serve as a prudent guideline for investors navigating this segment of the market.

You might also like: