Is Your Colorado Insurance Plan Keeping You From Your Health? Shocking Costs Exposed!

Healthcare coverage is at the forefront of national discussions, particularly as Congress grapples with changes to tax credits associated with the Affordable Care Act (ACA). This debate centers on enhanced subsidies for insurance premiums, a key financial support system for many Americans.

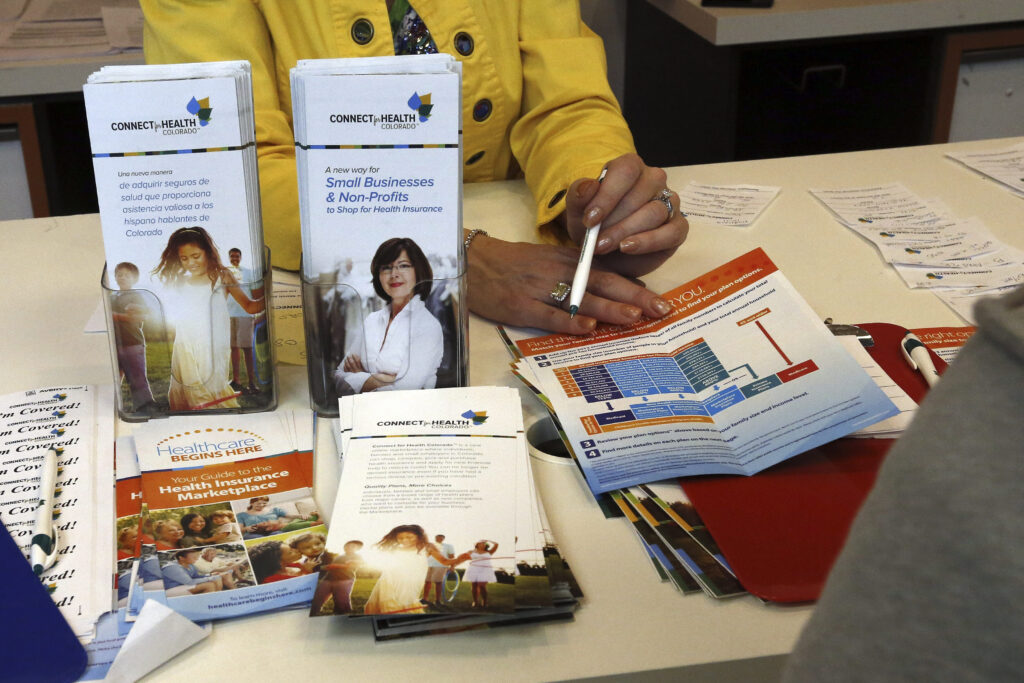

The individual market, which serves those who do not receive health insurance through their employer or government programs like Medicaid or Medicare, is crucial for many. In Colorado, approximately 7% of residents rely on this market, often purchasing plans through the state’s marketplace, Connect for Health Colorado, which uniquely offers subsidized premiums.

Despite five years of substantial growth in enrollment, this year witnessed a 2% decline in individuals signing up for health insurance plans on the marketplace. Currently, around 277,000 Coloradans are enrolled, yet many are facing increasing costs due to diminished federal financial assistance.

The Colorado Health Institute has been analyzing the state's health insurance landscape for years, particularly since the ACA's implementation in 2014. Their latest report highlights that nearly 100,000 Coloradans with incomes exceeding 400% of the poverty line are experiencing significant hikes in insurance costs. For a family of four, that threshold is pegged at $137,000 annually.

“People in this group are seeing significantly higher costs for their coverage,” the report indicates. This rising financial burden is felt by many middle-income families who find themselves grappling with expenses that exceed what is considered a living wage in Colorado.

Moreover, satisfaction levels among those enrolled in the individual market are troubling. According to the Colorado Health Access Survey, only about half of individual market enrollees report being satisfied with the healthcare system, a stark contrast to their counterparts covered by employer-sponsored insurance, Medicaid/Child Health Plan Plus (CHP+), and Medicare.

“Individual market enrollees are consistently dissatisfied or unhappy with the healthcare system,” noted Chrissy Esposito, Research and Programs Manager at the Colorado Health Institute. “The common thread that we see trending with that unhappiness is the cost being a barrier to getting care.”

In an interview with CPR Health Reporter John Daley, Esposito elaborated on the financial challenges faced by those in the individual market. “The cost and affordability issues for individual market enrollees do not stop at the cost of buying the insurance plan,” she explained. “These individuals are skipping necessary care at much higher rates compared to those with Medicare, Medicaid, or employer-sponsored insurance.”

Many enrollees are purchasing insurance with the hope of access, but when it’s time to seek care, they often find themselves deterred by high out-of-pocket expenses like deductibles. “They’re pulling on the reins and saying, ‘my out-of-pocket max or my deductible is too high, I’m going to forego care for right now,’” Esposito said.

After over a decade with Colorado's marketplace, public sentiment regarding healthcare costs has not improved. Esposito noted that individuals in the market continue to express dissatisfaction over the healthcare system, with cost frequently highlighted as a major obstacle.

Finding a provider who accepts their insurance is another significant hurdle. Many enrollees report challenges in securing appointments with in-network providers, necessitating searches beyond their immediate area to access even basic care, such as routine checkups. This coverage instability is compounded for those transitioning from employer insurance or losing Medicaid eligibility.

“When you have to find someone else to help provide your care, it can lead to discontinuity in services,” Esposito stated. This situation not only complicates access to healthcare but also undermines the purpose of having insurance in the first place.

Despite these challenges, the ACA's marketplace has made strides in reducing the uninsured rate in Colorado, with approximately 94% to 95% of residents now covered. However, as Esposito points out, the focus should also be on ensuring these individuals can afford the services they require. “Let’s get them insured and then let’s make sure they can get the services and care they need for a price that makes sense for themselves and their family,” she urged.

As Congress continues its deliberations on healthcare subsidies, the future of the individual market remains uncertain. The interplay between access to affordable plans and actual care received is critical, posing vital questions for policymakers and residents alike. The need for collaboration among state legislators and federal officials has never been more urgent as Coloradans strive for a healthcare system that truly meets their needs.

You might also like: