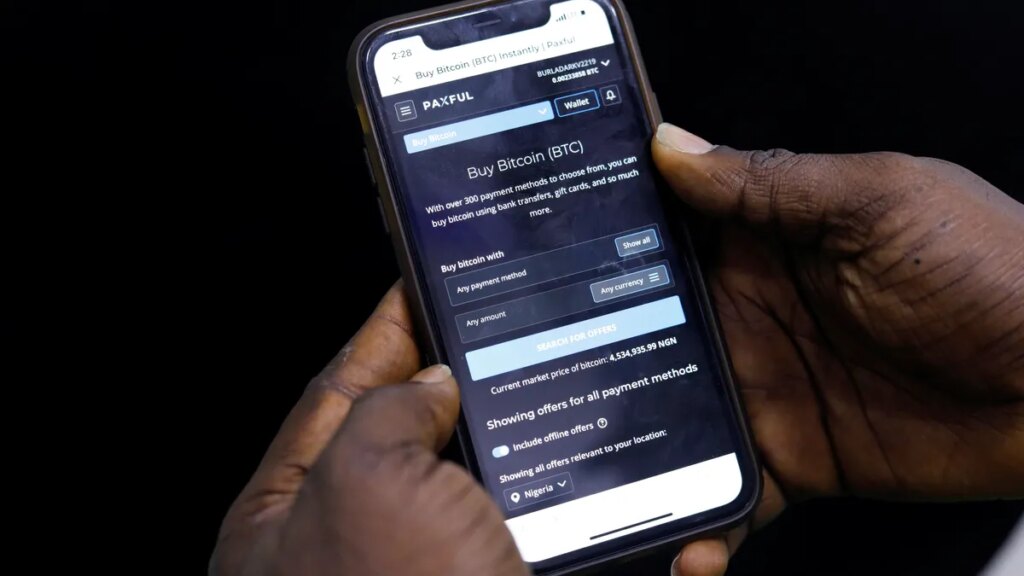

Crypto Meltdown: Why Bitcoin Just Lost $500 Billion—Is Your Investment Next?

In a significant move for the cryptocurrency industry, President Donald Trump has signed the Genius Act, establishing the first comprehensive U.S. law regulating stablecoins. This legislation arrives at a challenging time for the crypto market, which has faced a dramatic downturn this month, shedding more than $1 trillion in value.

The world of cryptocurrencies is experiencing heightened turbulence, with Bitcoin plummeting to levels not seen since April. Currently, it is down over 33% from its all-time high of more than $126,000 in early October, officially marking its entry into bear market territory, defined as a drop of at least 20% from peak levels. As of 1:29 p.m. ET, Bitcoin was trading at $83,776.81, reflecting a 3.18% decrease.

Experts have noted that this month's crypto decline could lead to Bitcoin's first annual loss since 2022, with the digital currency now down about 10% this year. "It seems early in the selloff process," remarked Hyunsu Jung, CEO of publicly traded crypto-treasury company Hyperion DeFi.

The Factors Behind Crypto's Decline

Analysts attribute the ongoing cryptocurrency crash to a combination of factors. Cryptocurrencies typically move in tandem with riskier growth stocks, particularly in sectors like artificial intelligence and technology, which have also faced declines amid concerns about inflated valuations and an uncertain economic outlook.

Jung elaborated, stating, "It would be difficult to attribute selling to a single factor. The current state of the market is risk assets across equities and crypto both seeing pullbacks — due to multiple factors such as potential exhaustion of the AI trade." Additionally, uncertainties surrounding global interest rates and moves toward cash by major crypto holders, including investment firm BlackRock, are impacting market stability.

The initial sell-off in cryptocurrencies, especially Bitcoin, breached numerous technical support levels, triggering a cascading effect of sales among trend followers. According to Tom Essaye, founder of Sevens Report Research, critical signals contributed to the intensified selling:

- The relative strength index (RSI), which measures the strength of price movements, did not rise alongside Bitcoin's price in October, indicating potential further declines.

- Bitcoin's breach of the key support level at $106,000 generated substantial selling activity, primarily driven not just by short-term traders, but also by long-term investors exiting the market.

Essaye noted that the trend of high-volume selling on down days has persisted, with a 4.4% drop occurring on some of the highest volumes recorded in the latter half of 2025.

This sharp decline has raised concerns about a possible wave of forced selling. Jim Reid, an economist at Deutsche Bank, warned that the situation could compel retail investors to liquidate other assets to meet margin calls—a scenario in which brokerages demand additional funds or securities from investors to cover shortfalls precipitated by sharp price declines.

Once the dust settles, some experts believe opportunistic investors might seek to enter the market. George Smith, portfolio strategist at LPL Financial, observed a significant increase in cryptocurrency-related products and blockchain mining firms among institutional investments. This shift underscores a growing appetite for digital assets among institutional investors, often referred to as "smart money."

David Namdar, CEO of CEA Industries, the largest corporate holder of Binance Coin, cautioned potential investors, stating, "No one should ever invest beyond their risk tolerance. Historically, moments like this, when sentiment is low and volatility is high, have often been where long-term value is created. Anyone considering an investment should think in years, not days, and should understand the asset’s inherent volatility."

As the landscape of cryptocurrencies continues to evolve, the implications of the Genius Act are yet to be fully realized. However, it undoubtedly marks a pivotal moment in the regulatory approach to digital assets in the United States, as the market grapples with both immediate pressures and long-term opportunities.

You might also like: