Is Your Smartphone About to Cost You $500 Extra? The Shocking Tax That Could Leave You Behind!

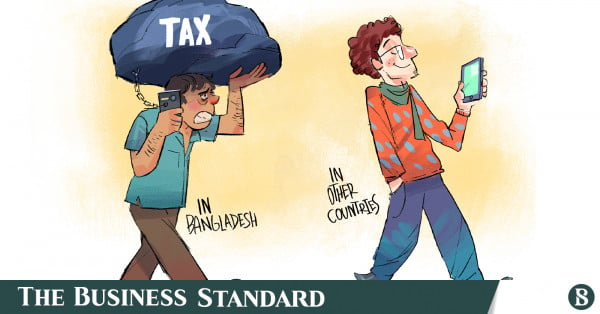

High Smartphone Prices in Bangladesh: A Consumer's Dilemma

As international travelers return from the US, Europe, or India, many face a common request from friends and family: "Bhai, amar jonno ekta phone niye ashis" (please bring me a smartphone). It's a plea driven by a stark reality—smartphones in Bangladesh can cost significantly more than in other parts of the world, often by as much as 80% or more.

The cost disparity extends across all major brands, with Apple's iPhone 17 retailing for about $799 (around Tk97,000) in the US. In contrast, the same device is priced at approximately Tk1.8 lakh (over $2,000) in Dhaka. Similar price hikes are seen with other global brands like Samsung and Vivo, compelling consumers to look for alternatives.

The Tax Burden: A Key Factor

The crux of the issue lies in Bangladesh's steep import duties, which reach up to 61%. Originally designed to protect local manufacturing, these taxes have backfired, inflating prices and pushing consumers toward the grey market, where phones can be 30-50% cheaper. Such a scenario has created a troubling environment for legitimate retailers and local manufacturers, who struggle to compete with illegally imported devices.

According to industry data, Bangladesh sells approximately 3.2-3.5 million smartphones every month, with around 80-85% of these being Android devices from brands like Xiaomi, Oppo, and Infinix. However, the pricing strategy has left the local smartphone market disconnected from international norms. For instance, the Vivo X200 is priced at RMB 4,299 (approximately Tk73,800) in China and ₹65,999 (around Tk90,500) in India, but it retails for Tk133,999 in Bangladesh.

The high costs are attributed to a combination of heavy taxation, compliance costs, and supply chain uncertainties. Faiz Ahmad Taiyeb, a special assistant for the Ministry of Posts, Telecommunications and ICT, mentioned that the government is considering significant cuts to import duties to align prices with regional markets.

"In other markets, supply chains are predictable," stated a leading distribution company's CEO, who wished to remain anonymous. "In Bangladesh, uncertainty itself adds cost." This creates a vicious cycle where higher prices limit consumer access, exacerbating the issue of digital exclusion in a country where smartphones increasingly play a crucial role in education and financial transactions.

The Grey Market's Impact

The presence of the grey market is particularly pronounced in urban centers like Dhaka, where unofficial phone shops thrive. These retailers bypass taxes by sourcing phones from countries with lower import duties, selling products at prices that are often 40-50% cheaper than official channels. A salesman in Jamuna Future Park noted that many customers prefer these cheaper options, creating a challenge for legitimate retailers.

"Why would they pay extra when they can get the same device cheaper?" he asked, highlighting the consumer frustration that drives the trend.

Local manufacturers, including companies like Walton and Symphony, struggle to compete, often operating below capacity due to high production costs and illegal imports. "Until illegal imports stop, the local industry won't survive," said Mohammad Zahirul Islam, managing director of Smart Technologies, which assembles HONOR smartphones locally.

Experts argue that the current tax structure is unsustainable. The president of the Mobile Phone Industry Owners Association of Bangladesh, Zakaria Shahid, emphasized that high taxes remain the single biggest factor affecting smartphone prices. He pointed out that rising raw material costs compound the issue, making competitive pricing nearly impossible.

In a broader context, the severe price discrepancies also raise questions about digital equity in Bangladesh. Mohiuddin Ahmed, president of the Bangladesh Mobile Phone Consumers' Association, remarked, "When the US and UK can keep smartphone import taxes near zero, Bangladesh's nearly 60% levy makes devices unnecessarily expensive. A phone is not a luxury product—reducing taxes is essential for broader digital inclusion."

With the government now planning to implement a National Equipment Identity Register (NEIR) to verify every mobile handset on Bangladesh's telecom networks, the future of the smartphone market remains uncertain. Many hope that easing the tax burden could revitalize the market, making smartphones more accessible to everyone.

You might also like: