Colorado's Shocking Shift: Is the Governor's New Plan a Secret Voucher Scheme in Disguise?

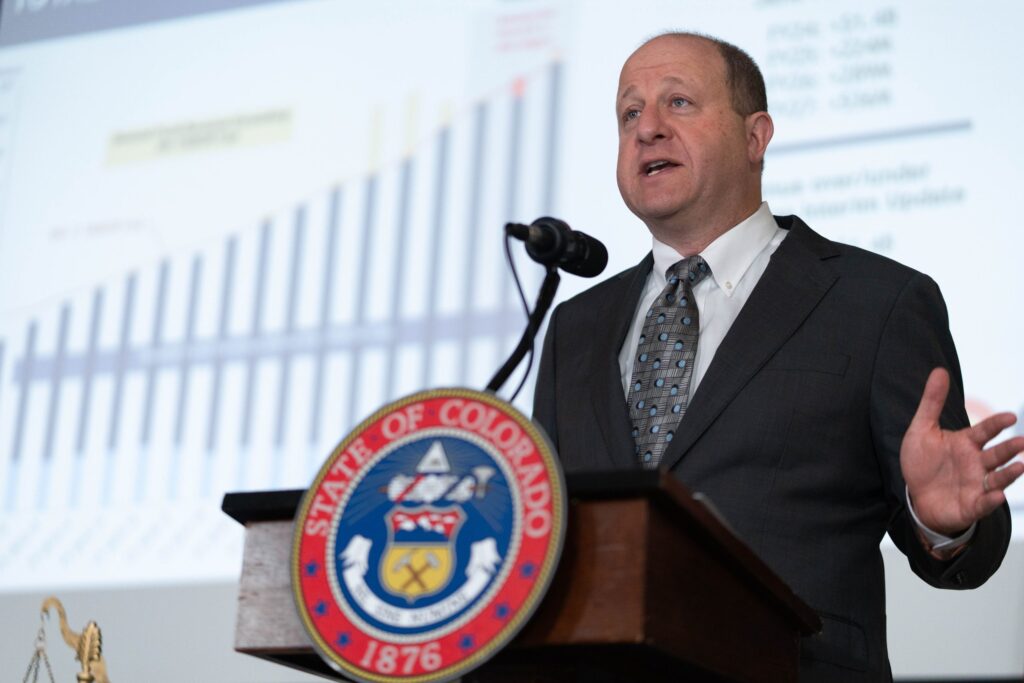

Colorado's Democratic Governor Jared Polis has announced plans to opt into a new federal program that many critics argue will effectively funnel public funds into private schools, despite his assertion that he opposes using taxpayer money for private education. This initiative, which has sparked significant backlash from education advocates and public school supporters, is part of a broader trend influenced by federal tax and spending measures enacted under former President Donald Trump.

In a letter dated Wednesday, various education organizations—most notably organized by Great Education Colorado—urged Polis to reject the federal program. They referenced Colorado voters' history of opposing voucher schemes, having rejected three proposals to fund private education in recent years. “We can all agree that our public schools can and must do better,” the letter states, underscoring concerns that public funds should not support families already choosing private or religious schools.

The federal program allows families to use scholarship money for various educational expenses, including tuition for private schools, which can include religious institutions, as well as fees for public school activities. The proposal, set to take effect in January 2027, permits taxpayers to claim a federal tax credit of up to $1,700 for donations made to scholarship granting organizations. These organizations are then responsible for distributing funds to students across income levels, with eligibility for families earning up to 300% of the area median income. For instance, in Eagle County, a family of four could qualify for scholarships with an income of up to $399,600.

Despite expressing opposition to the congressional Republicans' federal tax and spending measure—which he labeled a “terrible bill”—Polis insists that participating in the federal program is a “no-brainer” if it means securing additional support for Colorado's students. He believes that tapping into this tax credit will ultimately benefit local educational programs. “Fundamentally, it’ll empower more parents to be able to afford that after-school program or the summer program that they want for their kid,” he stated in a recent interview.

Critics worry that the federal program could serve as a stepping stone towards a comprehensive voucher system in Colorado, which would involve directing state public funds to private education. According to Tony Lewis, executive director of the Donnell-Kay Foundation, a nonprofit focused on educational improvement, the federal tax credit scholarship program and state voucher programs are fundamentally different. “I don’t see a federal tax credit leading to a statewide voucher program...that’s a viable path,” he said.

Conversely, Kevin Welner, director of the National Education Policy Center at the University of Colorado, argues that any system providing tax credits for donations inevitably involves public funds. He cautioned that such programs could ultimately undermine public education. “Let’s not fool ourselves about the voucher or voucher-like element in this policy,” Welner remarked, calling for careful scrutiny of the program.

As discussions unfold, the rules governing the federal tax credit scholarship program remain unclear. States are awaiting more detailed guidance from the U.S. Department of the Treasury and the IRS, which are currently in the process of soliciting public feedback. Many education advocates are urging Polis to delay a decision until the regulations are established. They worry that the framework will lack flexibility, ultimately leading to a federally controlled program that could diminish public school resources.

Some educators and advocates express concern that the new program could exacerbate inequities within Colorado's education system, potentially favoring families in wealthier areas who may have better access to scholarship funds. Kathy Gebhardt, a member of the Colorado State Board of Education, emphasized the importance of focusing on improving educational outcomes for all children rather than pursuing potentially flawed programs. “I think when things appear to be too good to be true, they are,” she cautioned.

Supporters of the federal program, however, argue that it could provide critical resources for low-income families, allowing them to access educational opportunities that might otherwise be out of reach. Nicholas Hernandez, executive director of Transform Education Now, views the scholarships as a chance to offer children access to music lessons, tutoring, and extracurricular activities that could enrich their educational experiences. “These dollars in one form or another are going to go to kids,” he stated, emphasizing the moral imperative to utilize available funding for Colorado's youth.

As the state navigates these contentious waters, the debate over the federal tax credit scholarship program underscores a larger national dialogue about the role of public versus private education and the best ways to support all students. With the deadline for making a decision just around the corner, Colorado stands at a crossroads that could shape the future of education funding in the state.

You might also like: