Is Investing Green the Next Goldmine? Experts Say You Could Lose THOUSANDS If You Don't Act NOW!

Welcome to our weekly newsletter where we highlight environmental trends and solutions that are moving us to a more sustainable world.

Molly Segal here. In the context of rising living costs, many are questioning if it's possible to invest green while still achieving financial goals. This week, we delve into various aspects of climate-conscious investing, from its viability to innovative solutions in tackling waste and adapting to climate change.

Can You Actually Invest Green and Make Money?

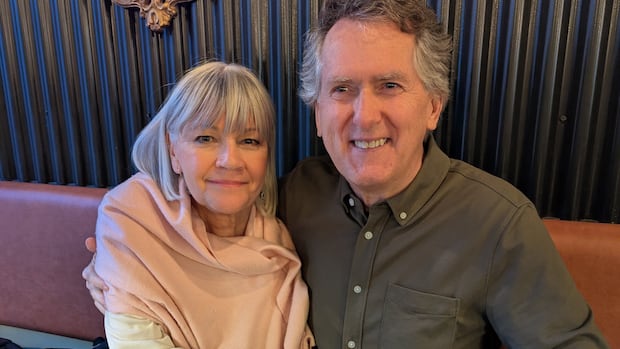

Lori and Rick Findlay, a retired couple from Toronto, embody the growing trend of individuals seeking to align their financial decisions with their values. At 68, Lori, a former school principal, and her husband Rick, who is semi-retired and involved in clean technology, have adopted a lifestyle aimed at minimizing their impact on the planet.

From repairing rather than replacing broken items to utilizing public transportation, their commitment to climate-conscious choices extends to their investment strategy. After discovering that many of their funds were tied to fossil fuels, Rick remarked, “I found sort of down deep in these funds, a lot of fossil fuel and I just said, 'OK, that's it. We have to make a change.'”

Initially, when the Findlays approached their financial advisor about aligning their investment strategy with their environmental beliefs, they were told that maintaining their current investments was necessary to keep their returns. Unconvinced, they sought out Tim Nash, president and founder of Good Investing Financial Planners, who specializes in climate-conscious investing.

Nash advocates a two-pronged approach: divesting from fossil fuels while also focusing on “doing more good” through impact investing. He emphasizes that the first step to divestment can be as simple as where one banks. “The big banks in Canada are some of the largest financiers of fossil fuels in the world,” he explained. A report by BloombergNEF revealed that in 2024, Canada’s major banks invested a staggering $200 billion in fossil fuels.

For those eager to make climate-conscious investments, Nash warns that green investing isn't solely about buying into eco-friendly securities. It involves maintaining a balanced portfolio that reflects one's values while excluding industries that don't align with them. “I would say now it is incumbent on us to sort of look under the hood to make sure that it does fit your definition of green,” he said, highlighting the divisive nature of certain energy sources like nuclear power.

Joshua Pearce, a professor of engineering and business at Western University in London, Ontario, takes a broader view of what constitutes green investing. He suggests that individuals consider investing in “hard assets,” such as heat pumps and solar panels. “What I encourage everyone to do is to consider hard assets first and treat them the same way you do all your other investments,” Pearce stated, noting that the return on investment for solar panels can be significant depending on the location.

Both Nash and Pearce assert that reframing the concept of green investing can influence a variety of life choices, such as avoiding lifestyle inflation—opting for smaller living spaces or more efficient vehicles, or even purchasing a bicycle as an eco-friendly investment.

For the Findlays, the transition has been affirming. Lori reports that they have successfully met their investing goals without compromising returns, stating, “Even in today's crazy, upside-down, unpredictable world, we could indeed invest in a relatively safe and conservative, diversified portfolio.” They ensured their investments were evidence-based and sustainable, achieving a balance between ethical considerations and financial aspirations.

As climate change continues to reshape investment landscapes, individuals like the Findlays are paving the way for a new paradigm where financial success harmonizes with ecological stewardship. For those looking to make a positive impact, understanding the nuances of climate-conscious investing is not just an option; it's becoming a necessary component for future financial planning.

Reader feedback: We welcome your thoughts and questions about climate-conscious investing, the environment, and more. Connect with us at [email protected].

You might also like: