Tech Stocks Plummet: Is Your Bitcoin Investment About to Crumble? Shocking Strategy Alert!

Tech stocks connected to Bitcoin saw a slight uptick in overnight trading, but this modest recovery did little to offset the significant losses experienced the previous day. The volatility of the cryptocurrency market continues to alarm investors, with Bitcoin's value plummeting 21% over the last month. As of today, Bitcoin has stabilized around $87,000 per coin, reflecting a 0.72% increase.

Among the companies impacted, crypto trading platform Coinbase experienced a downturn of 4.76% yesterday but managed to rebound slightly with a 1.37% increase in overnight trading. Similarly, Robinhood shares fell 4.09% yesterday, only to inch up 0.63% in premarket activities today.

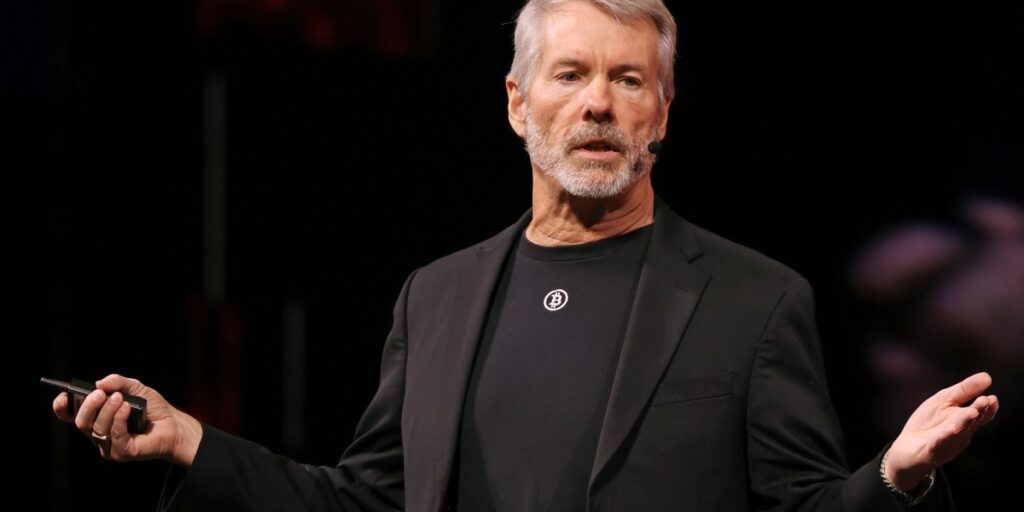

However, the most pressing concern in the crypto realm is the performance of Michael Saylor’s Strategy, a prominent Bitcoin treasury company. Currently, its market capitalization stands at $50.6 billion, which is now less than the value of the 650,000 Bitcoins it holds, worth approximately $56.7 billion. The key financial metric to watch for Strategy is its “mNAV” (multiple to net asset value), which compares the company’s enterprise value of $65.2 billion to its Bitcoin holdings. This ratio was reported at 1.15 this morning, suggesting that Strategy’s enterprise value exceeds its Bitcoin assets by 15%.

Yet, if the mNAV dips below 1, Strategy could face a significant crisis. Such a scenario would undermine the rationale for holding its stock, likely stalling any future capital influx and triggering substantial selling pressure on its shares. Adding to the tension, Phong Le, the CEO of Strategy, discussed potential measures on a podcast, indicating that the company might sell some of its Bitcoin to meet dividend commitments on its debt and preferred shares. “Now, as we are looking at Bitcoin winter... my hope is our mNAV doesn’t go below one,” Le stated. “But if we do and we didn’t have other access to capital, we would sell Bitcoin.”

This admission is particularly striking given that Saylor has historically maintained a position against selling any of the company’s Bitcoin holdings. Currently, Strategy controls just over 3% of the total Bitcoin supply, raising concerns that selling off any portion could set off a chain reaction in the market.

Meanwhile, traders who have been betting against Strategy through leveraged plays are already facing dire consequences. Two exchange-traded funds, MSTX and MSTU, designed to amplify returns on the underlying Strategy stock, have lost over 80% of their value. In total, alongside a third fund, MSTP, these ETFs have lost approximately $1.5 billion over the past month, according to Bloomberg.

Strategy's stock also took a hit on Tuesday when it announced the creation of a $1.44 billion "U.S. dollar reserve" to ensure it can meet dividend obligations. The company claims it has enough liquidity to navigate the upcoming 12 to 24 months, as reported by the Financial Times.

As sentiment in the crypto market remains bearish, some investment experts are forecasting continued declines. Patrick Horsman, chief investment officer at BNB Plus, warned the Wall Street Journal, “I think we could see Bitcoin get all the way back to $60,000... We don’t think the pain is over.”

Here's a snapshot of the broader market as the opening bell in New York approaches:

- S&P 500 futures were up 0.24% this morning, while the last session closed down 0.53%.

- STOXX Europe 600 was up 0.35% in early trading.

- The U.K.’s FTSE 100 increased by 0.38% in early trading.

- Japan’s Nikkei 225 remained flat.

- China’s CSI 300 was down 0.48%.

- The South Korean KOSPI rose by 1.9%.

- India’s NIFTY 50 saw a decline of 0.55%.

- Bitcoin remains at approximately $87,000.

You might also like: