Is Bitcoin on the Brink? Hedge Funds Make Shocking $2 Billion Bet Against the Dollar!

Hedge funds are making a significant bet against the U.S. dollar, reaching some of the most extreme short positions seen in two decades. This trend comes at a time when macroeconomic indicators suggest that the dollar may be poised for a rebound. As hedge funds pile into these anti-dollar bets, the implications extend beyond traditional markets, potentially impacting the cryptocurrency landscape in unexpected ways.

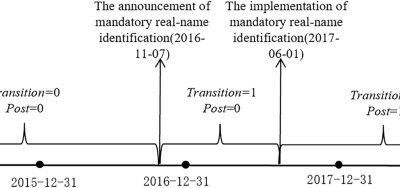

Current data from analysts reveals that hedge funds are entrenched in "extreme short" territory on the U.S. Dollar Index (DXY). The Positioning Index indicates that this is one of the most lopsided positioning levels in years, which has historically been followed by a recovery in the dollar rather than continued declines. Analyst Guilherme Tavares pointed out that when trades become too crowded, it may signal a reversal. He noted, “Hedge funds are holding significant short positions in the DXY, and historically, similar levels have often preceded solid buying opportunities—at least for a short-term rebound.”

Over the last 20 years, instances of heavy shorting of the dollar have consistently culminated in a bounce-back, forcing traders to unwind their positions quickly. This raises concerns about the sustainability of the current market sentiment surrounding the dollar.

Macro Tone Doesn’t Support the Anti-Dollar Hype

Warnings from EndGame Macro support this view, highlighting that extreme short positioning rarely exists in calm market conditions. They emphasized that hedge funds are effectively “shorting a weak dollar,” making the market susceptible to even minor shifts in sentiment or liquidity. Analysts have underscored that the broader environment does not favor ongoing dollar weakness as traders seem to believe. Conditions such as tightening dollar funding markets, a slowing economy, and expectations for future interest rate cuts by the Federal Reserve could all contribute to a sudden reversal in the dollar’s fortunes.

“This setup doesn’t guarantee a major dollar bull run, but it does tell you that the downside is probably limited,” EndGame Macro stated.

Why Crypto Should Care: A Rising Dollar Is a Threat

For the cryptocurrency market, the stakes are particularly high. Analysts emphasize the direct inverse relationship between the DXY and digital assets. As one expert warned, “Dollar up = bad for crypto. Dollar down = good for crypto. If the dollar keeps grinding higher into 2026… you may have to kiss that beloved bull market goodbye,” referring to the potential adverse effects on digital currencies like Bitcoin and Ethereum.

The risk here is significant. If the U.S. dollar rebounds strongly from these crowded short positions, as history suggests, the cryptocurrency market could face considerable pressure. Investors were hoping for a multi-year bull cycle in crypto, but a stronger dollar could change those expectations swiftly.

Technical analysts also note encouraging signals for a potential USD reversal. According to market technician Daan Crypto, the DXY has recently closed above its 200-day moving average for the first time in nearly nine months. This could break a 7–8 month downtrend, adding to the argument for a dollar resurgence. Daan stated, “This isn’t ideal for risk assets and has been putting pressure on as well… Good to keep an eye on.”

As the dollar strengthens, combined with factors like the yen's weakness and recent market volatility, technical momentum may align with current positioning data to fuel a potential rebound. If hedge funds find themselves needing to unwind their extreme short positions, the dollar could experience a sharp rise, creating further pressure on Bitcoin, Ethereum, and similar risk assets.

The coming weeks will be critical for the DXY’s price action, funding conditions, and guidance from the Federal Reserve. These dynamics will determine whether the bullish narrative surrounding cryptocurrencies can hold or if a more defensive market phase is upon us.

You might also like: