Is a 30% Stock Market Crash Imminent? Here's What the Fed Isn't Telling You!

The volatility of the stock market has been a topic of increased concern as the S&P 500 recently experienced a 3.5 percent decline from its all-time high at the end of October. Despite this recent dip, the broader picture remains positive, with the index showing a robust gain of over 12 percent over the past year. This current pullback, while notable, does not indicate we are entering a bear market. However, market sentiment has shifted, and many analysts are expressing anxiety that the ongoing AI boom may have overstretched its valuations, leading to fears of a more significant downturn.

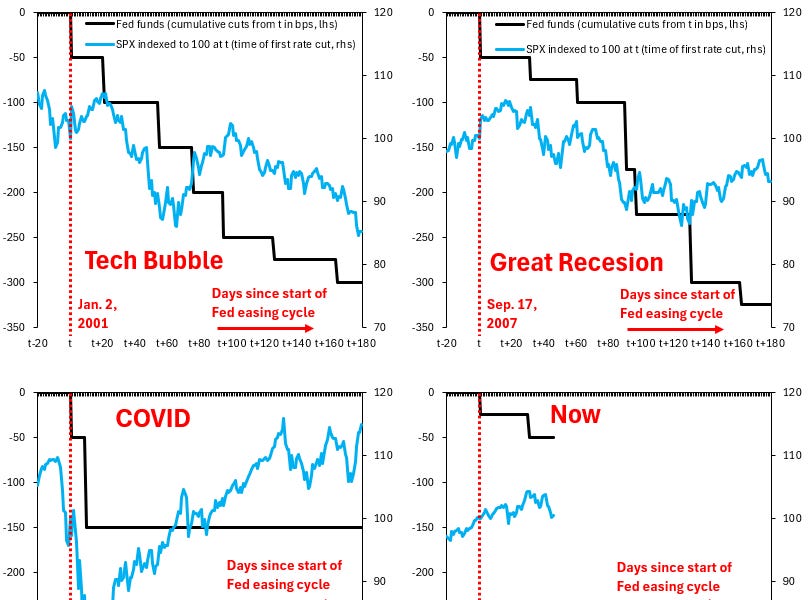

A key question emerging from this context is whether the Federal Reserve can effectively intervene to prevent a stock market meltdown. Historically, the Fed has struggled to stave off sharp declines during economic downturns. A look back at three significant market drawdowns that coincided with U.S. recessions reveals that, in none of these instances, was the Fed able to prevent a steep drop in stock prices. These events include: (i) the bursting of the IT bubble in 2001, (ii) the onset of the Great Recession in 2007, and (iii) the COVID-19 market shock in 2020.

During the IT bubble burst in 2001, the Fed began its easing cycle with an emergency 50 basis point cut on January 3. The S&P 500 was already in a downward trajectory, and despite the Fed's intervention, the index fell approximately 15 percent within 180 days. Similarly, the Great Recession saw the Fed's efforts yield limited results as the markets continued to struggle.

The 2020 COVID-19 pandemic presented a unique situation. The Fed was much quicker to implement quantitative easing measures during this crisis, which resulted in a much swifter recovery for the stock market. The rapid announcement of aggressive monetary policies helped the S&P 500 rebound after an initial steep sell-off, underscoring the importance of timely interventions during economic shocks.

Currently, while the S&P 500 is experiencing a modest pullback, it's essential to note that market valuations appear stretched. This raises the possibility of a more significant decline should an unexpected shock occur. Analysts caution that, while the Fed has shown a greater willingness to implement quantitative easing quickly—evidence from the COVID-19 response suggests that speed is critical—it remains uncertain whether such measures would be put into place with the same urgency in the current economic climate.

In summary, the recent fluctuations in the S&P 500 reflect broader uncertainties in the market, particularly surrounding the valuations tied to the AI boom. The historical performance of the Fed during market downturns suggests that while it can take steps to mitigate damage, it cannot always prevent declines from occurring. Investors and analysts alike would do well to remain vigilant, as the potential for a sharper pullback continues to loom.

You might also like: